|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

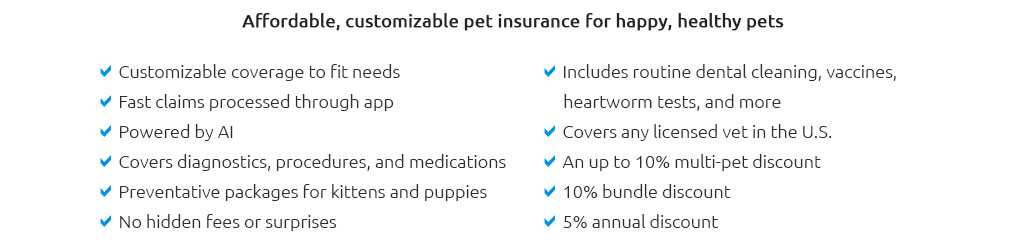

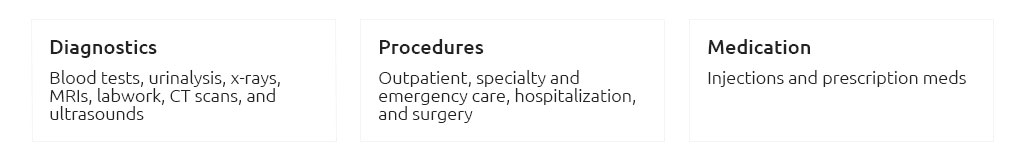

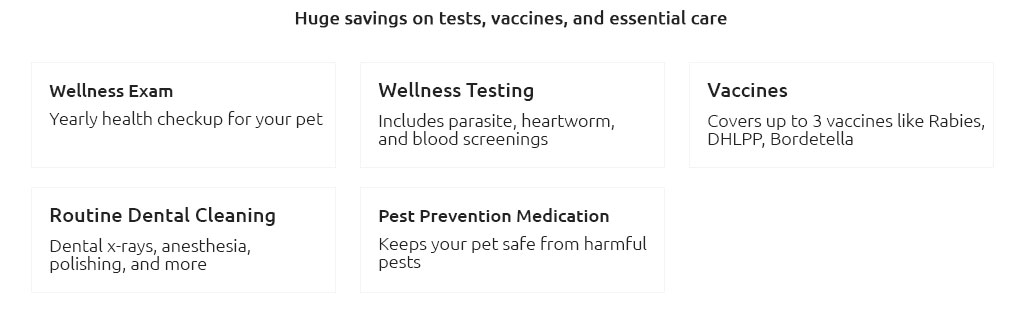

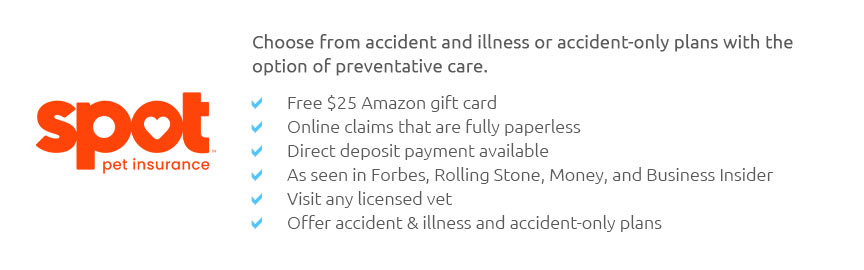

Best Pet Insurance for Pets: A Comprehensive GuideWhen it comes to our beloved furry, feathered, or scaly companions, ensuring their health and well-being is a top priority. One way to safeguard their future is through pet insurance, a financial safety net that can cover unexpected veterinary costs. With numerous options available, finding the best pet insurance for your pet can be daunting. This guide offers insights, key factors to consider, and subtle recommendations to help you make an informed decision. First and foremost, understanding what pet insurance typically covers is crucial. Most plans offer coverage for accidents and illnesses, but the extent of coverage can vary significantly. Some policies include wellness care, covering vaccinations and routine check-ups, while others focus on emergencies and major health issues. It's essential to evaluate what aligns best with your pet's needs and your financial situation. When comparing pet insurance providers, there are several key factors to consider. Coverage limits are a critical aspect; some insurers have an annual cap, while others may impose per-condition limits. It's advisable to look for plans with high or no limits to avoid unexpected expenses. Additionally, deductibles and reimbursement levels should be examined closely. A lower deductible means less out-of-pocket cost before coverage kicks in, but this may also increase the monthly premium. On the other hand, choosing a higher reimbursement percentage ensures that you receive more back from each vet bill, though this, too, can affect your monthly payments. Another vital consideration is the waiting period-the time before coverage becomes active. During this period, any incidents or illnesses may not be covered, so it's important to choose a policy with a minimal waiting period. Furthermore, many insurers have age restrictions, with some policies only available to pets below a certain age or becoming more expensive as pets grow older. Reputation and customer service are also significant. Researching reviews and asking for recommendations from fellow pet owners can provide insight into a company's reliability and how it handles claims. Companies with a straightforward claims process and responsive customer service are preferable. Finally, let's touch on some subtle recommendations. Healthy Paws often receives high praise for its comprehensive coverage and straightforward claims process, though it may not cover routine care. Trupanion is lauded for its lack of payout limits and customizable deductibles, making it a robust choice for those seeking flexibility. Meanwhile, Embrace stands out for its wellness rewards program, which can be a boon for those looking to cover routine care. Frequently Asked QuestionsWhat is the best age to get pet insurance? The best age to get pet insurance is as early as possible. Younger pets are less likely to have pre-existing conditions, making it easier and often cheaper to secure comprehensive coverage. Does pet insurance cover pre-existing conditions? Most pet insurance policies do not cover pre-existing conditions. However, some insurers may cover conditions that are curable and have been symptom-free for a certain period. Is pet insurance worth it for older pets? While premiums for older pets tend to be higher, insurance can still be worthwhile to cover the costs of chronic conditions and age-related illnesses, which can be expensive without coverage. How do I file a pet insurance claim? Filing a claim typically involves filling out a form provided by your insurer and submitting it along with your vet's invoice. Many companies offer online portals or apps to streamline this process. https://www.thetimes.com/money-mentor/pet-insurance/best-pet-insurance

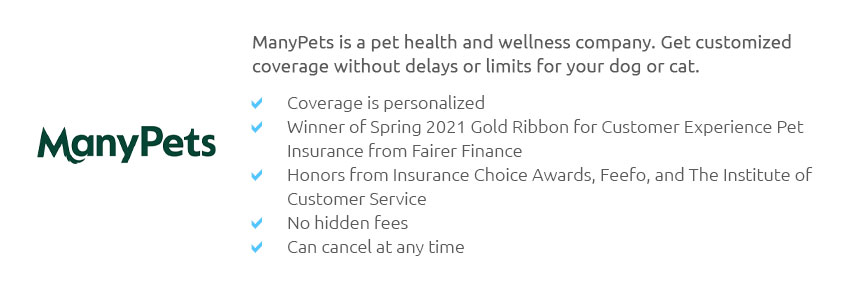

The best pet insurance providers - Petsure - Many Pets - Waggel - M&S Bank - Cover My Pet - Honourable mentions - Animal Friends - Petplan. https://www.trupanion.com/

Veterinarians want to provide the best care, without worrying about the costs to pet parents. With our unlimited coverage, they ... https://www.petsbest.com/

Our BestBenefit pet insurance plans cover a wide range of illnesses including diabetes, allergies, hip dysplasia, and hereditary and congenital conditions.

|